AstraZeneca joins radiopharmaceutical deals spree with $2.4B buyout of Fusion

The deal is the third recent buyout of a radiopharmaceutical developer in recent months, following similar deals from Eli Lilly and Bristol Myers Squibb.

Excerpt from the Press Release:

AstraZeneca is the latest large pharmaceutical company to make a sizable bet on radiopharmaceutical drugs for cancer, agreeing on Tuesday to acquire longtime biotechnology partner Fusion Pharmaceuticals in a deal worth up to $2.4 billion.

AstraZeneca will acquire all of Fusion’s shares for $21 apiece, or about $2 billion. The British drugmaker could add another $3 per share via a financial instrument known as a “contingent value right” if Fusion meets an unspecified regulatory milestone. Should Fusion hit that mark, the buyout would be worth $2.4 billion.

AstraZeneca is paying a 97% premium for Fusion’s shares, which ended trading on Monday at $10.64 apiece.

The deal is the 11th biopharmaceutical buyout in 2024, adding to the sector’s fastest M&A start in at least six years, according to BioPharma Dive data. It’s also the third recent large transaction involving a maker of radiopharmaceuticals, following Eli Lilly’s $1.4 billion deal for Point Biopharma in October and Bristol Myers Squibb’s $4.1 billion takeout of RayzeBio in December.

Click the button below to read the entire Press Release:

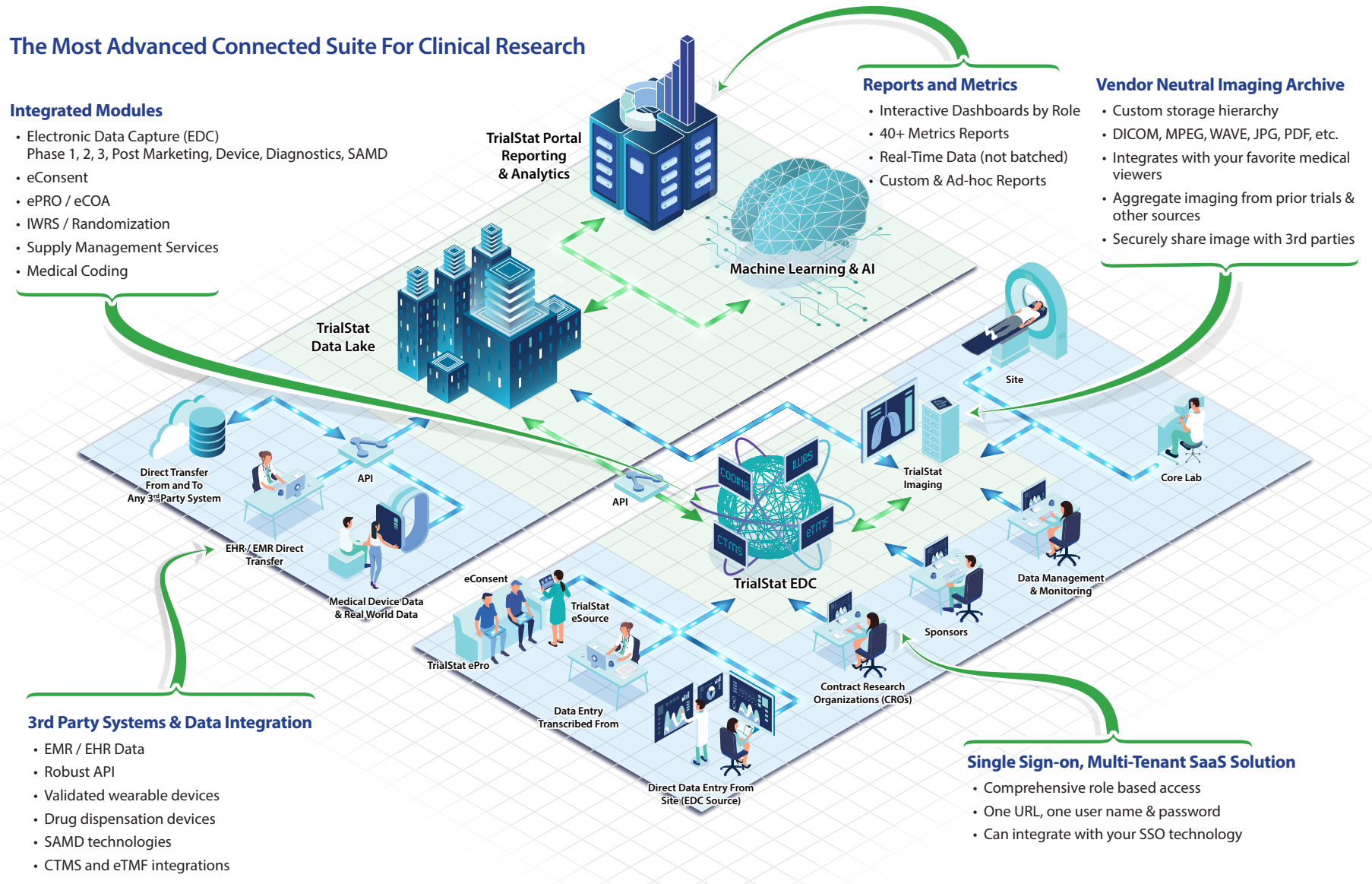

Discover What Sets TrialStat Apart From Ordinary EDC Platforms

Click the image or button below to explore our eClinical Suite Platform and discover what sets TrialStat apart from competing EDC platforms.

Request Your Demo Today!

From rapid database build through database lock, we deliver consistent quality on-time and on-budget. Ready to upgrade your eClinical toolkit?